Purpose

The purpose of this post is to outline the key functions of the Reimbursable and Non-Reimbursable Expenses in CREModels Commercial Acquisition models. The tutorial will go through what to input into the model and how the outputs are calculated.

Overview

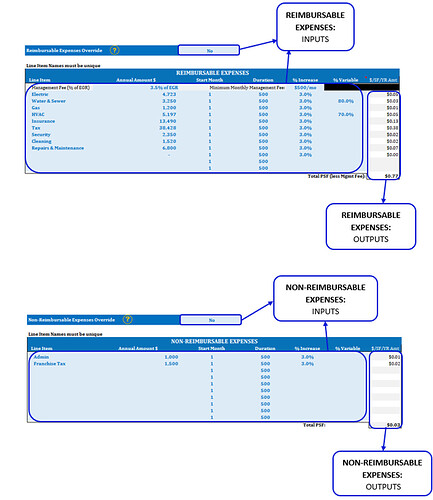

In the Commercial Acquisition model, all Operating Expenses can be entered in the Reimbursable Expenses table or the Non-Reimbursable Expenses table. The total Reimbursable Expenses will be used to calculate Expense Reimbursement income from the tenants. However, if the User does not want to detail out expenses, both Reimbursable and Non-Reimbursable Expenses have the option to be overridden by selecting ‘Yes’ in the override section.

Reimbursable Expenses

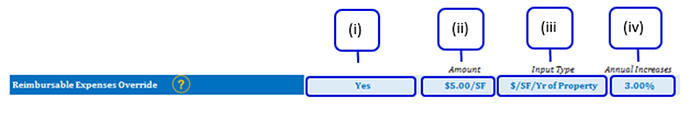

1. Reimbursable Expenses Override

(i) If ‘Yes’ is selected, the amount entered will be the total reimbursable expenses.

(ii) User inputs the Reimbursable Expense amount based on the input type.

(iii) There are 3 input options: $/SF/Yr, % of EGR, % of PGR.

- Note: $/SF/Yr is based on total net SF of the property.

(iv) If ‘$/SF/Yr’ is selected, the user has the option to enter the projected annual increases/growth.

2. Reimbursable Expenses

For each expense line item, the user must enter the name of the line item and the initial annual $ amount. The user can enter an annual % increase for each expense and what % of the expense line item is variable. The portion of the expense line item deemed variable by the input entered in the % Variable column shall be varied by occupancy. For example, as shown above, the initial annual Gas expense is $1,200, but 50% of this expense is variable. So, if during Year 1, the property is only 80% occupied, then the actual Gas expense will be: ($600) + ($600*80%) = $1,080.

Additionally, the user can add in a Start Month and Duration for each Reimbursable Expense. The model will begin each expense at the Start Month entered, and then continue that expense for the number of months entered in Duration. The expenses will no longer continue after this period.

For Management Fee, the user must enter what % of Effective Gross Revenue that the Management Fee shall be calculated as. The user may also enter the Minimum Monthly Management Fee, which is the minimum monthly management fee expense that applies from month 1 on.

The last column of the Reimbursable Expenses table displays the initial calculated $/SF/Yr expense amount, with the total of these expenses (not including Management Fee) displayed in the final row of the table.

Non-Reimbursable Expenses

1. Non-Reimbursable Expense Override

(i) If ‘Yes’ is selected, the amount entered will be the total reimbursable expenses.

(ii) User inputs the Reimbursable Expense amount based on the input type.

(iii) There are 3 input options: $/SF/Yr, % of EGR, % of PGR.

- Note: $/SF/Yr is based on total net SF of the property.

(iv) If ‘$/SF/Yr’ is selected, the user has the option to enter the projected annual increases/growth.

2. Non-Reimbursable Expenses

For each expense line item, the user must enter the name of the line item and the initial annual $ amount. The user can enter an annual % increase for each expense and what % of the expense line item is variable. The portion of the expense line item deemed variable by the input entered in the % Variable column shall be varied by occupancy.

Additionally, the user can add in a Start Month and Duration for each Non-Reimbursable Expense. The model will begin each expense at the Start Month entered, and then continue that expense for the number of months entered in Duration. The expenses will no longer continue after this period.

The last column of the Non-Reimbursable Expenses table displays the initial calculated $/SF/Yr expense amount, with the total of these expenses displayed in the final row of the table.