Purpose

The purpose of this post is to outline the key functions of the Acquisition Loan in CREModels Multi-Family Acquisition model. These features should be universal across all acquisition models unless noted otherwise. This outline will also cover how the metrics and values within the Acquisition Loan portion of the Debt Assumptions are calculated.

Overview

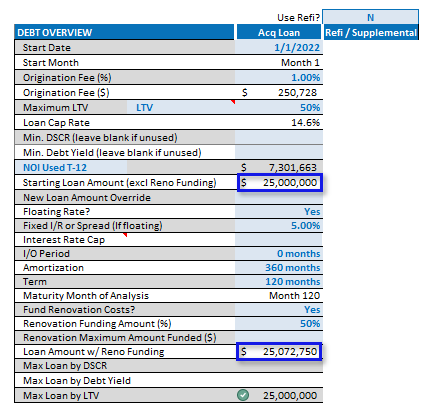

Debt Overview

The first section of the Debt Overview inputs includes general debt assumptions for LTV, DSCR, Debt Yield, and NOI Used (for calculating Loan Cap Rate). To begin, the user must enter a loan Start Date which must be no later than the Closing Date entered in the General Info section at the top of the INPUTS tab.

If the user enters a loan Start Date that is before the Closing Date, the model will assume there is an existing loan and the loan amount must be entered in the Existing Loan Original Amt. input.

The user may also enter a loan Origination Fee (%), if applicable. The Origination Fee will be used in the calculation of Total Closing Costs (within the Acquisition Assumptions section to the left).

a) LTV/LTC

The Maximum LTV input will be used for the calculation of the Starting Loan Amount. By entering an LTV % input, the model will calculate the Starting Loan Amount equal to the LTV (%) times the Purchase Price.

A user also has the option (via the dropdown) to use LTC rather than LTV. The LTC method will determine Starting Loan Amount based on the Total Acquisition Uses.

b) DSCR - Debt-Service Coverage Ratio

The user has the option to enter the Min DSCR required by the lender. If a value is entered for Min. DSCR, the model will determine the Starting Loan Amount based on the lesser of the calculated Max Loan by DSCR and the calculated Max Loan by LTV.

c) Debt Yield

In addition to a limitation by Min DSCR, the user has the option to further limit the Max Loan by Debt Yield. If a value is entered for Min. Debt Yield, the model will determine the Starting Loan Amount based on the lesser of the calculated Max Loan by Debt Yield and the calculated Max Loan by LTV.

d) NOI Used/Loan Cap Rate

The NOI Used value is for the calculation of the Loan Cap Rate. By default, the NOI Used is the Forward 12 NOI. The Forward 12 NOI is equal to the total NOI generated commencing on the first month after the month of loan origination (e.g., if the loan Start Date is 1/1/2022, the NOI Used Forward 12 will be equal to the NOI generated from 2/1/2022 through 1/31/2023).

If using NOI Forward 12 and LTV is selected as the Loan Funding Method, the Loan Cap Rate will be calculated simply as follows:

![]()

Alternatively, if using NOI Forward 12 and LTC is selected as the Loan Funding Method, the Loan Cap Rate will be calculated as follows:

The user also has the option to modify the taxes used in calculating this Forward NOI. In the cell directly to the right of NOI Used, the user may select (via the dropdown) either “Use Abated Taxes” or “Use UnAbated Taxes”. Abated Tax information can be entered by the user in the Real Estate Taxes section of the model. In order to specify Abated Taxes, the user must select “Use Detail” from the dropdown in the “Tax Input Method” selection. This will expand the Real Estate Tax Detail table below.

If “Use Abated Taxes” is selected for NOI Forward 12, then the model will calculate the Forward 12 NOI using the Tax Abatements calculated within this table.

e) New Loan Amount Override

Rather than basing the Loan Amount on NOI, the user may enter a $ value for the Acquisition Loan using the New Loan Amount Override input. If a $ value has been entered for New Loan Amount Override, the model will ignore other inputs (LTV, Min. DSCR, Min. Debt Yield, Interest Rate, etc.) when calculating the Starting Loan Amount.

Interest

a) Floating Rate

The user has the option to enter a floating interest rate spread. To do this, the user can select ‘Yes’ in the ‘Floating Rate?’ row of the Acquisition Loan. If the user chooses to input a floating rate, then the user may navigate to the ‘Floating Rate Curve’ tab of the model and adjust the rates on a monthly basis.

b) Interest Rate Cap

If the user selects ‘Yes’ in the Floating Rate row of the Acq. Loan section, then the user may enter an input for the Interest Rate Cap to be applied if a floating rate increases above a certain rate. If the interest rate does go above the Interest Rate Cap, then the model will use the input for the interest rate cap for the month(s) of overage.

Note: If no Interest Rate Cap is entered, then the model will have no limitations on increases of a floating interest rate.

c) Fixed I/R or Spread

The Interest Rate of the Acquisition Loan can be entered as a fixed interest rate or a floating interest rate. By default, the model assumes the interest rate to be fixed – the user can simply enter the Interest Rate in the Fixed I/R or Spread input.

To enter a floating interest rate, the “Floating Rate?” input must be set to “Yes”, then the Spread must be entered in the Fixed I/R or Spread input.

d) I/O Period

The I/O Period input allows users to enter a number of months during which only interest is to be paid on the loan (the interest-only period).

Funding Renovation Costs

If the user has included Renovation Costs (in the Renovation Costs section), the user may choose to use the Acquisition Loan for funding Renovation Costs as well. First, “Yes” must be selected from the “Fund Renovation Costs?” dropdown. Then, the user must enter the % of the Renovation Costs to be funded by the loan (Renovation Funding Amount (%)). A maximum $ amount of the Renovation Costs to be funded by the loan can be entered in the Renovation Maximum Amount Funded ($) input.

The example above is set up with “Up Front” Renovation Costs, which is why these costs appear in the Acquisition Uses section, however, the Renovation Funding feature of the Debt Assumptions will also function the same if Renovation Costs are set up as “Over Time”. If the model is set up to disperse Renovation Costs over time, Renovation Costs will not appear in the Acquisition Uses section. Up Front or Over Time disbursement is determined by the applicable input within the Renovation Costs section.

Note: The Renovation Maximum Amount Funded ($) input is only a value used to limit the $ value of Renovation Costs to be added to the loan and cannot be used as an input on its own to indicate the $ value the user would like to add to the loan to be used for Renovation Costs. In the example below: The user has left the Renovation Funding Amount (%) blank and entered $150,000 for the Renovation Maximum Amount Funded ($). Since the user hasn’t entered a Renovation Funding Amount % the Loan Amount has not changed.

Refi/Supplemental

In addition to the Acquisition Loan, the Multi-Family Acquisition model allows the user to input information for a refinancing/supplemental loan. First, the user must select “Y” from the Use Refi? dropdown.

Then, the user must enter a Start Date in order for all other debt inputs to be revealed. The user must enter a Maximum LTV and Loan Cap Rate. Loan Amount will be calculated as: (NOI/Loan Cap Rate)*LTV (subject to limitations by DSCR and Debt Yield). Alternatively, the user may enter a $ value in the New Loan Amount Override input.

Note: All other inputs under Refi/Supplemental function in the same manner as the Acquisition Loan inputs.