Purpose

The purpose of this post is to outline the key functions of the Acquisition Loan in the CREModels Commercial Acquisition model. This outline will also cover how the metrics and values within the Acquisition Loan portion of the Debt Overview are calculated.

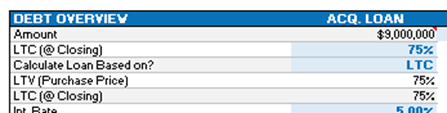

Debt Overview

The Debt Overview inputs include general debt assumptions for LTV/LTC/Acquisition Loan Amount, Interest Rate, I/O Period, Amortization, CapEx Funding, and Maturity. The cells shaded blue are where you may enter inputs and the cells shaded gray are the cells which produce outputs based on the values of the inputs. The information for the acquisition loan will either be an output or an input in the Acquisition Loan section of Debt Overview and will be based on the user inputs.

Acquisition Loan Inputs

a) LTV/LTC

Within the Debt Assumptions section of the Commercial Acquisition model, the user has the option to adjust the Acquisition Loan Amount using an LTV or LTC input, or alternatively, a total $ amount. First, the user should select from the “Calculate Loan Based on?” dropdown either LTV, LTC, or $ Amount. If LTV or LTC has been selected, the user can enter the % value (in the “LTC (@ Closing)” row input) to be used as LTV or LTC. If $ Amount is selected, the user can enter the total $ amount of the Acquisition Loan in the same input as LTV/LTC % would be entered.

The total Loan Amount used in the model will be displayed in the first row of the Debt Overview table. Below the LTV/LTC dropdown, the effective LTV and LTC % will be displayed. This can be especially useful when using a $ amount to set the Acquisition Loan to quickly reference what LTV or LTC that the manually inputted Loan Amount would be. The value used to determine the LTV % will simply be the entered Purchase Price in the Acquisition Assumptions section. The cost used to determine the LTC % will be the sum of the Purchase Price, Total Closing Costs, and Total Capital Costs.

b) Interest, I/O Period, & Amortization

Next, the user must enter the Interest Rate of the Acquisition Loan. The interest rate entered will be used to calculate the interest payments throughout the term of the Acquisition Loan. If the user enters a number (of months) for the Interest-Only Period (I/O Period), only interest payments will be made during these months. Then, the user must enter the months of Amortization. These inputs will all be used to determine the principal and interest payments of the Acquisition Loan.

c) CapEx Funding?

The input for “CapEx Funding?” is a drop-down option that allows the user to choose either Yes or No as to whether a portion of the Loan Amount will be used to fund capital expenditures. By choosing Yes, the model is taking into account that a portion of the loan will be used to fund capital expenditures. If the user chooses Yes, then the cells for TI Funding, LC Funding, and Other Capex Funding will be become editable inputs. The user then must enter what percentage of TIs, LCs, and Other CapEx will be funded by the Acquisition Loan. The total Other Cap Ex is based on all cost inputs (excluding Capital Reserves) entered in the OTHER CAPITAL COSTS table of the Commercial Assumptions section. By choosing No, the loan will not be used for capital expenditures.

d) Maturity (Months)

Finally, the user must enter the length of the Acquisition Loan term in the “Maturity (Months)” input. Once the user has entered the number of months until maturity, the model will calculate and output the Maturity Date based on the Origination Date. The Origination Date is the same as the Analysis Start Date, which the user specifies in the General Info section.

2nd and 3rd Loans

In addition to the Acquisition Loan, the user has the option to include inputs for a 2nd and 3rd loan. By entering a loan amount within the first row under the “2nd Loan” column, all applicable loan inputs will become visible. The user must enter the same inputs as with the Acquisition Loan, except the user must also enter the Origination Date for the loan. Additionally, a Loan Fee (in total $) may be entered in the last row of the Debt Overview table.