Purpose

The purpose of this post is to outline the key functions of the Other Income features in the MF Dev model. These features should be universal across all development models unless noted otherwise.

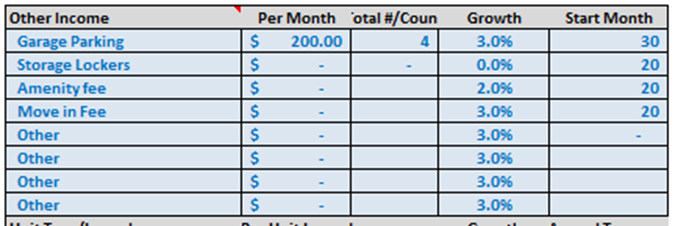

Other Income

Along with rental revenue, the Multi-Family Development model allows for the inclusion of additional non-rental income with the Other Income feature. This income is then added to Net Rental Revenue in the calculation of Total Effective Revenue.

Other Income

The line items in this column may be edited as needed, with some examples being parking garage rent, storage locker rent, move-in fees, pet rent, etc. The items entered into this column will show up as line items in the annual cash flow reports.

Per Month

The $/month received from each type of other income input in the previous column is entered here.

Total #/Count

The # of units or tenants from which each type of additional income is received is entered in this column. If there is certain income received from all units on a monthly basis, that would be entered into this table with the Total #/Count equaling the total number of units in the property.

Growth

Entered into this column is the annual % growth rate of each income type.

Start Month

The start month input for each type of other income determines when each income type will begin to be modeled. If a start month is entered which is earlier than the Month of First Occupancy entered into the Unit Mix, then the model will show the income beginning in the Month of First Occupancy.

Unit Turn/Lease Income

Unit turn/Lease Income inputs are fees or income received when a lease is signed, such as an application or admin fee. There is no input for the number of units/tenants that the specific fee is received from, so the income will be added for all new leases. The annual turnover input will affect how many leases are turned over annually once the property is stabilized, and in turn, how often this income is received per year. Prior to stabilization, this monthly income is calculated by multiplying the $ per unit leased inputs with the # of units leased in that month. The property is considered to be stabilized when the model has leased a # of units that equals the total # of units entered in the unit mix.

Retail Component & Office Components

The Other Income feature allows for in the inclusion of income received from any attached retail or office space that is sometimes found within multifamily properties. The retail and office component sections are where the rental income for these tenants would be added to the model.

Retail/Office Component

The names of the retail and office tenants are entered into this column.

Sq Ft

The SF of each of the retail or office components are entered in this column. The SF of these components are not considered part of the SF of the multifamily property, which comes from the unit mix, but the SF of the retail and office components are reported in the Executive Summary report under the Retail and Office Metrics, respectively.

Base Rent

In this column, base rent must be entered as $/SF/YR.

Growth

Entered into this column is the annual % growth rate of each income type.

Start Month

Each start month input determines when each component will begin to be modeled. Due to these components being separate from the normal multifamily tenants, if the entered Start Month for retail or office income is earlier than the Month of First Occupancy in the Unit Mix, the model will still show this income beginning in entered Start Month.

Using the inputs from the two tables, the model will calculate Total Retail and Office NOIs for each analysis year will be calculated and reported in the Annual Cash Flows tab, calculated using the inputs from the retail and office component tables detailed above.

Both the retail component and office component sections have corresponding CAM Reimbursement sections where CAM and Real Estate Tax passthroughs can be created and modeled for these tenants. The Sq Ft input from the corresponding table above are brought down. Inputs for this section include the $/Sq Ft paid by tenants for each of CAM and Taxes, Growth rate %, and Start Month. There is also an input for CAM % passthrough. This input will change how much of the CAM is reimbursed by the tenants compared to the total CAM expense set forth by the $/Sq Ft and Growth inputs. Real Estate Taxes are assumed to be NNN in this model and will be subject to 100% reimbursement by tenants.

Summary Section: