Purpose

The purpose of this post is to outline the key functions of the Unit Mix feature in the MF Dev model. These features should be universal across all development models unless noted otherwise.

Unit Mix

Similar to the Unit Mix in the multifamily acquisition models, the Unit Mix in the multifamily development model allows for inputs that will affect the monthly and annual cash flows. Entering data for the inputs of Monthly Rents, Absorption, Vacancy Loss, Concession Amount, and Cutoff Occupancy will provide the necessary information for the model to output Net Rental Revenue, which is the first part of the Effective Revenue calculation, ultimately needed in order to calculate NOI.

Much like the CREModels multifamily acquisition model, the multifamily development model requires a breakdown of the different types of units found in the property. Unit types should be categorized based on a variety of characteristics. These characteristics/inputs are entered into the Unit Mix and further described here:

- Bedroom #

Number of bedrooms in that type of unit. The model will use this information for presentation in the Executive Summary.

- Unit Type & Floorplan

Unit Type will be a quick descriptor for each type of unit. This could be as simple as 1x1, 2x1, 2x2, etc., if each unit within those categories are the same size and rent, or it can be more in depth by including additional descriptors such as “renovated”, “large balcony/patio”, or “refurbished”. Floorplan is the code or descriptor used to keep track of each different types of floorplans, commonly found in an OM or sometimes on a property’s website. Each different unit type and floorplan should be entered under “UnitTypes” and “Floorplan”, respectively, on the far-right side, which will add to the drop-down list for each cell under “Unit Type” and “Floorplan” in the main section of the model.

- Units

Number of units that are included in each entered category. This input will change the % of Total column to the right of it. That % of Total column will then output %’s based on the number of units entered in for each unit type, the sum of which shall always be 100%.

- Avg Unit SqFt

Average SqFt for each type of unit. Along with the “Units” input, Avg Unit SqFt changes the Total SqFt column which calculates the total SqFt of each unit type in the property.

- Monthly Rent

The monthly rent charged for each unit type. Along with the “Avg Unit SqFt” input described in Subsection D, Monthly Rent changes the Rent/SqFt column which outputs the monthly rent per SqFt for each unit type.

The model will calculate weighted averages for $/SqFt/Month and Monthly Rent and can be found on the far-left of the Unit Mix section and take into account the distribution of unit types. $/SqFt/Month is taken from the weighted average at the bottom of the Rent/SqFt column and Monthly Rent is calculated by dividing the total monthly rent by the total SqFt.

Absorption

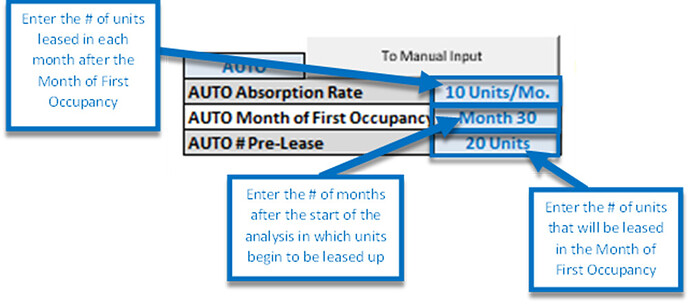

The absorption and vacancy inputs can be manipulated to model how many units are leased up and at what times and can be set to either Auto or Manual. When set to Auto, there are available inputs for Absorption Rate, Month of First Occupancy, and # Pre-Lease. The Absorption Rate input sets the number of units that are modeled to be leased up per month. The Month of First Occupancy input sets the month in which units begin to be leased up in the model. The # Pre-Lease input sets how many units are to be considered leased up in the Month of First Occupancy.

The model will also know not to lease up more units than there are available. For example, for 49 total units and the absorption inputs shown below, the model will show 20 units rented in Month 30, 10 units in Month 31, 10 in Month 32, and 9 in Month 33.

Normally set to Auto, when the highlighted input is set to Manual, the other three input rows disappear and you may click the “To Manual Input” button which will automatically jump to the line in the Monthly Cash Flows sheet where how many units that shall be rented in specific months can be manipulated.

Rent Growth

The rent growth inputs allow for changes in the rent increases (in %) year-over-year. This can be set to either annual compounding or monthly compounding, which will show its effect in the annual cash flows for rental revenue.

Vacancy & Credit Loss

This % input will determine the lost rental revenue due to unit vacancy or credit loss. This change can be seen in the Annual Cash Flows in the “Less Vacancy & Credit Loss” line which effects Net Rental Revenue.

Concession $ Amount

Editable $/month input which changes the lost rental revenue due to rent concessions. This change can be seen in the Annual Cash Flows in the “Less Concessions” line which effects Net Rental Revenue and can be seen in the photo above.

Cutoff Occupancy

The Cutoff Occupancy is the level of occupancy where the model stops applying concessions. Think of concessions as a move-in special for the first X number of leases signed. If the Concession Occupancy is set to 50% for example, then the concessions are offered to the first 50% of leases, which will be shown in the Monthly Cash Flows.

Summary Section: